UPDATED June 2, 2015

As the 2015 84th Texas Legislature began, several conservative Tea Party Senators aligned with Lt. Gov. Dan Patrick filed bills taking varying approaches to funnel public school tax dollars to private schools.

All the bills failed, including Senate Bill 4, a priority measure for Patrick that passed out of the Senate.

Original Article April 25, 2015

After school voucher defeats over several legislative sessions, Republican Lt. Gov. Dan Patrick’s public school privatization crusade passed the Senate hurtle this week. Senate Bill 4, passed out of the senate on a 18-12 vote along partisan lines after the third reading of the bill. The bill now goes to the Texas House for consideration,

Patrick has championed school voucher legislation since 2007, his first term in the Texas Senate.

Only one Democrat voted for SB4, Sen. Eddie Lucio (R-Brownsville), while two Republicans voted against it, Sen. Konni Burton (R-Colleyville) and Sen. Robert Nichols (R-Jacksonville).

SB4 must now work its way through the Texas House where it will find resistance from both House Republicans and Democrats who don't like the idea of siphoning money out of public school funding. House Public Education Chairman Jimmie Don Aycock R-Killeen) whose committee would have to approve the bill before it reaches the floor, has said that for lawmakers in the lower chamber to even start a conversation about providing state support to private schools, it would have to be assured of adequate quality control.

SB4 would create scholarships for students to attend private and religious schools. Under provisions of the bill, private businesses would receive a tax

Fueled by people moving to Texas, the state’s school system continues to grow at a frenetic pace, with a current enrollment of more than five million students. No state has experienced more growth in the number of K-12 students over the last decade than Texas. Hispanic student population growth tops the list, but enrollment among all ethnic groups, except Caucasians, has continued to grown by both numerical and percentage measures over the last three school years. These increases in minority enrollment and decrease in white enrollment continues a trend that dates back to the 1980s.

Texas public school student enrollment stood at 5,075,840 for the 2012-2013 school year with the following composition:

- 51.3 percent Hispanic;

- 30.0 percent white;

- 12.7 percent African American;

- 3.6 percent Asian; and

- 1.8 percent multiracial.

This intentional underfunding has weakened Texas' public eduction system so that it increasingly struggles to deliver quality education to our young Texans.

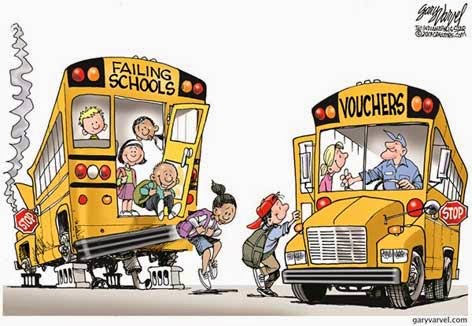

Republicans point to some 500 of Texas' 8,317 K-12 public schools that now under-perform, due to lack of adequate funding, as proof that public eduction just doesn't work and therefore argue the only solution is privatization and vouchers.

The standard conservative argument for public school privatization is that students and parents, unhappy with their under-performing neighborhood public school, should have the "free market" right to choose a (private) school that fulfills their child’s educational needs.Sen. Patrick says of the corporate tax

In theory, vouchers allow children from poor and lower-income and mostly minority backgrounds to attend private schools instead of public schools. SB4 will provide 75 percent of the private school tuition cost with parents covering the last 25 percent.

In practice, vouchers are loaded with problems. One of the bigger ones is that many poor and lower-income families can't the part of the tuition cost not covered by the voucher. Voucher programs do not prohibit private schools from discriminating on the basis of race or sexual orientation, or any other "religious claim" on which they might refuse enrollment. So the voucher program winds up mostly benefiting only students from wealthier from mostly Anglo families.Adequate public school funding, not private school vouchers, are the best way to support Texas' 5 million students attending 8,317 K-12 school across 1,265 public school districts.

Another significant issue with voucher programs, by any name, is that many private schools that accept vouchers are religious schools, where creationism is taught instead of actual science. This is a problem because public education money is not only diverted to private for profit schools, which are not required to administer state tests or meet state accountability standards, public money is also used to teach information contrary to the public school standard, including creationism in place of evolution. (14 Wacky "Facts" Kids Will Learn in Louisiana's Private Voucher Schools)

Various public school privatization schemes, such as Patrick's tax

More than a dozen states have implemented voucher-type programs with mixed results, according to the National Conference of State Legislatures. There is no evidence that students are helped by such programs perform any better, but the public money being diverted into private schools is helping Wall Street investors.

Traditionally, "public" education had been a tough market for private corporations to break into -- fraught with politics, tangled in bureaucracy and fragmented into tens of thousands of individual schools and school districts from coast to coast. But with the American Legislative Exchange Council (ALEC) pushing legislation in nearly every state that funnels public school tax money into private corporation "for profit" schools, Wall Street is inflating another big profit balloon.

Wall Street investors are pouring private equity and venture capital into scores of companies that aim to profit by taking over broad swaths of privatized public education. Investment in the K-12 education sector soared to a record $389 million in 2011, up from $13 million in 2005, with 2012 investments passing 2011 levels.

Even though studies show that costly private schools don’t produce any better educational results than free public schools, for-profit schools have popped up all around the nation in recent years because of how valuable they are to corporate America. In fact, the historic Chicago Teachers Union strike earlier this year was largely in response to the city’s push to open up more charter schools to replace traditional public schools.

Education is a recession-proof industry that will always be in high demand. The corporate money-changers know if they can get their hands on this industry, "reform" it to replace decently-paid teachers and faculty with McTeachers, and then get taxpayers to foot the bill, quarterly profits and lavish bonuses for CEOs can explode. Even in so-called "non-profit" charter schools, management can make big bucks.

ALEC and its Texas conservative lobbying partners Texas Public Policy Foundation (TPPF) and Tea Party parent Americans for Prosperity strongly promotes public school privatization and supports vouchers, taxpayer savings grants, tax credits, tuition reimbursements, and any other program that diverts public tax dollars into privatizing public education.

The scam of the Republican school privatization plan is apparent when you do the arithmetic. One public school privatization voucher scheme under consideration for Texas is called Taxpayer Savings Grants (TSG). Taxpayer Savings Grants is a statewide program that allows parents the "choice" to transfer their child from a public school to a private school and use a Taxpayer Savings Grant voucher to pay part of the tuition.

The Taxpayers' Savings Grant voucher model is fatally flawed, as is every other public school privatization voucher scheme. First, few parents can afford to use the vouchers because private-school tuition balances are too expensive. Second, private schools would not have the capacity to enroll large increases in student admissions. Third, this voucher plan would mainly subsidize relatively wealthy students already attending private schools.

Proponents of Taxpayer Savings Grants claim that the public school system would save $3,000 for every student who transfers to a private school and that "just under 7 percent of students would take advantage" of a $5,143 voucher to attend a private school.

Let's look at the arithmetic. The Texas Education Agency reports that public-school enrollment K-12 in Texas in 2010-11 was 4,933,617 students. Seven percent would total 345,353 students. Private school enrollment in 2009, reports the National Center for Education Statistics, was 313,360. There is no way private schools would have the capacity to enroll 345,353 more students.

Meanwhile, students already attending private schools would also receive the same $5,143 voucher per student. For 313,360 students already attending private schools, the cost to state government would total $161 million a year.

Here's another serious problem with TSG: The public school student transferring to a private school must pay the difference between the $5,143 voucher and the full price of tuition at the private school. If tuition is, say, $15,000 per year, parents would have to come up with the $9,857 difference. Private-school tuition often runs in the range of $10,000 to $20,000.

The average tuition cost for the top 10 private schools in the Dallas area in 2010-2011 was $20,000 according to the Dallas Business Journal. If a parent gets a $5,000 voucher to apply towards private tuition, s/he still needs to pay $15,000 of their own money. This makes attending a top-tier private school out of reach for most middle class parents and all low income parents.

Most of the 345,353 students who might want to use a private school voucher are simply priced out of the market. What's more, 2.9 million school kids from low income families take part in subsidized-lunch programs. These kids could never dream of attending a private school. A quality public school education is their only hope of creating a better life for themselves and their future families.

Voucher proponents tell us that the present system of public education "is broken" and that "no student should be locked into a poorly performing school because that happens to be where they live." But how will moving 7 percent of the students, or less, to private schools fix a "broken" public education system for the remaining 4.7 million (93%) Texas students?

In simple terms, a voucher programs amount to additional cuts in state funding for public schools, and at a time when the State is not meeting its constitutional responsibility to adequately fund public schools.

The following are talking points regarding voucher programs:

✔ Another funding cut for public schools - At a time when Texas public schools are facing unprecedented, massive cuts to public education, and the structural deficit and broken school finance system have not been adequately addressed by the Texas Legislature, voucher programs only remove additional funding from public schools.The Texas legislature has a constitutional duty to support and maintain a system of public schools in this state. (Texas Constitution Article 7, Section 1) State statute imposes a further duty upon the legislature:

✔ General lack of accountability with voucher programs - The state maintains a laser focus on accountability, transparency, college readiness and measuring student performance, and should not consider a voucher program that does none of these. Further, voucher programs generally have no mechanism for tracking student progress and ensuring students receive a quality education. Private for-profit schools are exempt from state and federal accountability requirements and locally elected school board oversight.

✔ Voucher supporters often claim such a program will save the state money, but never say how. Actually, voucher programs could end up costing state tax payers more money, while removing money out of public school classrooms.

✔ Vouchers would help the wealthy at the expense of the poor – Under most plans, the voucher/taxpayer savings grants would not completely fund tuition at a good private school. So, only parents who can afford the rest of the tuition, as well as transportation, could take advantage of such programs.

The mission of the public education system of this state is to ensure that all Texas children have access to quality education that enables them to achieve their potential and fully participate now and in the future in the social, economic and educational opportunities of our state and nation. (Texas Education Code §4.001)In 1955, the economist Milton Friedman launched the privatized-school voucher concept. Except for a few small pilot programs, Friedman's voucher concept has never proven successful in 57 years because no one has been able to design a privatized model that works on the scale of any public school system.

"The Great School Voucher Fraud" is an informative position paper by Edd Doerr of Americans for Religious Liberty that explores the assault on public education, particularly the history and role of vouchers. The particular focus of this paper is on the history of religion in American public education, including what state constitutions have to say about the use of public tax dollars for religious purposes.Doerr, president of Americans for Religious Liberty, is a well-published writer, a former public school teacher (history, government, Spanish) and since 1966 has been a full-time professional in the religious freedom and church-state separation fields.

Article 7 of the Texas Constitution of 1876 made it the responsibility “of the state legislature to establish and make suitable provision for the support and maintenance of an efficient system of public free schools.”

The School Land Board (SLB) was established in 1939 by the 46th Legislature to manage the sale and leasing of public lands that fund the Permanent School Fund. The Permanent School Fund (PSF) was established in the state Constitution of 1876, the current charter of Texas law, to fund public eduction using revenues generated from Texas' land and mineral resources. The SLB’s responsibilities include approving land sales, trades and exchanges, and the purchase of land for the PSF. In addition to this, the SLB issues permits, leases and easements for uses of state-owned submerged land. The SLB is just one of nine boards and councils chaired by the Commissioner of the General Land Office. As chairman of nine boards or councils, the Land Commissioner oversees matters that range from state lands and coastal issues to veterans affairs.

The General Land Office of Texas (GLO) manages state lands and mineral right properties, including oil and gas production leases on more than 20 million acres of state land. State lands and mineral right properties include the beaches, bays, estuaries and other submerged lands out to 10.3 miles in the Gulf of Mexico, institutional acreage, grazing lands in West Texas and timber lands in East Texas, and oil and gas "mineral" rights every where. Revenue and royalties are suppose to be collected and distributed to public school districts on a per-pupil basis, helping to offset local school property taxes.

The Available School Fund is made up of the money set aside by the state from current or annual revenues for the support of the public school system. There are two major revenue sources for the fund: earnings from the Permanent School Fund managed by the School Land Board and 25 percent of fuel tax receipts.

After the GOP-controlled Legislature cut $5.4 billion from public education funding in 2011, more than 600 school districts statewide sued the state claiming the legislature isn't living up the education mandate spelled out in the Texas Constitution. Lawmakers restored about $3.4 billion in funding in 2013. Still, last year, a district judge in Austin declared the school finance system unconstitutional, saying funding was inadequate and unfairly distributed among school districts. The final outcome of this case is waiting a hearing the Texas Supreme Court.

Some charge that the Republican lawmakers do not require Texas' oil and gas producers, who make huge profits off of Texas public lands and resources, to support their fair and constitutionally mandated share of Texas' public education system.

More Information:

No comments:

Post a Comment